|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Modular Home: What You Need to KnowRefinancing a modular home can be a strategic financial decision, allowing homeowners to secure better interest rates, reduce monthly payments, or tap into their home's equity. This process is similar to refinancing a traditional home, but there are specific considerations to keep in mind. Understanding Modular Home RefinancingModular homes, constructed in factories and assembled on-site, often qualify for the same types of refinancing as site-built homes. However, lenders may have different requirements and conditions for these types of properties. Types of Refinancing Options

Steps to Refinance Your Modular Home

It's important to compare options, such as the refinance rates Madison WI, to ensure you're getting the best deal possible. Benefits and ChallengesRefinancing a modular home offers several advantages, such as lowering monthly payments, reducing interest rates, and accessing cash for other financial needs. However, it can also present challenges, including potential fees, closing costs, and the need to meet specific lender requirements. Potential Pitfalls

For those who may not have traditional income documentation, exploring a stated income mortgage refinance could be a viable alternative. FAQs About Refinancing Modular HomesWhat is the difference between modular and manufactured homes in refinancing?Modular homes are constructed in sections and assembled on-site, qualifying them for traditional home loans. Manufactured homes, built on a permanent chassis, may have different refinancing options due to their classification. Can I refinance my modular home with bad credit?Refinancing with bad credit is possible but may result in higher interest rates. Improving your credit score before applying can help secure better terms. How long does the refinancing process take?The process typically takes 30 to 45 days, depending on the lender and your preparedness with documentation. https://www.rockethomes.com/blog/homeowner-tips/refinance-manufactured-home

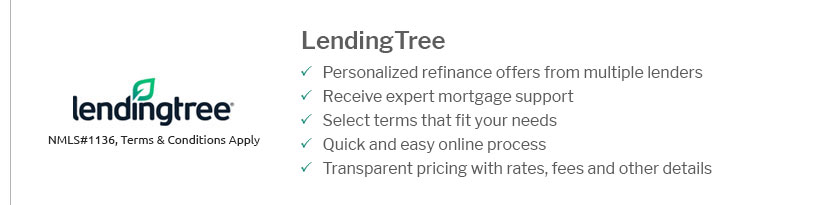

You can refinance a loan used to purchase a manufactured home as long as you meet the property and financial requirements for a refinance. Your ... https://www.lendingtree.com/home/refinance/mobile-home-refinancing/

Follow the five steps below to navigate the path to the best mobile home refinance whether you own a mobile home, manufactured home or a modular home. https://www.manufacturedhome.loan/refinance/

A refinance of your manufactured home, modular home, or mobile home can lower your monthly payments, which can add up to significant savings!

|

|---|